Four unvarnished truths look at the good, the bad, the ugly, and the essential in housing's post-depression recovery since 2010.

I used to like Andy Rooney when he was on CBS's 60 Minutes. He told the truth that oftentimes was in front of your nose, but people were either too polite or too distracted to see that truth.

Cranky and curmudgeon were virtues for him.

I also used to like Paul Harvey, the longtime radio essayist, who would find interesting stories that had a little known part to them. His introduction to the little known fact was: “and, now; the rest of the story.”

He was kind of curmudgeonly, too.

I find myself now cast as either Andy Harvey or Paul Rooney, the morphing of the two characters. Kind of like the Mog in Spaceballs: half man, half dog (he was his own best friend).

There are truths in the housing recovery numbers that are being ignored. The press is putting out happy-talk babble about how “hot” the housing market is. This hides how far off we still are from long-term norms. In the process the fundamental changes happening in housing and the opportunities that those changes are creating are being ignored.

Time to put on the cranky, curmudgeonly pants.

I keep reading the daily and monthly drumbeat of data about the housing recovery, all with an apparent positive spin. “August housing starts at an annual rate of 1,126,000, down 3% from the month earlier, but up 16.6% from August of 2014.” (Wall Street Journal, September 17, 2015)

So, short term the trend is bad, but long-term it is good, I guess.

But, one man’s ceiling is another man’s floor.

Compared to 587,000 starts (multi family and single family) in 2010, we are nearly double the rate that occurred at the bottom of the pit of the housing cycle. That’s great!

But, compared to the long-term (60 year) average of 1,678,000 starts per year, we are actually operating at between 67% of where we should be. That’s awful!

One month does not a full story make, though. The monthly data is pretty volatile and gets adjusted for a couple months after it first comes out.

Looking at the first 6 months of 2015, the data is pretty well settled. There were 536,000 starts (346,000 single family and 190,000 multifamily). This compares to the last 3 years first-half data as follows:

So what do we learn from this?

- Overall starts are growing at a year-over-year rate of slightly over 11%.

- Single-family starts are growing at a slower rate (9.1% recently).

- Multi-family starts are growing at a consistently faster rate than single family, but are decelerating.

- The mix of starts is still moving toward multi-family (now at 35.4%) while the proportion of single-family is still declining (down from 70.5% to 64.6% since 2012).

- These trends (overall starts growing, but the proportion of single-family declining) still show no sign of abating.

The first truth seems to be that although the industry is getting healthier, the conditions favoring single family are still muted in comparison to where we have been since the 1990s.

On a comparison basis, the single-family percentage of production was slightly over 80% for the 1990s and 2000s. In the 1960s it was 70.9%; in the 70’s it was 64.6%; and in the 1980’s it was 66.3%. In terms if mix, we are back to the 1970s.

Conservative underwriting, banks withdrawing from the industry, and scared/impaired millennials will do that.

Lost in the conversation on housing has been the status of manufactured housing. I look at manufactured housing placements (as opposed to shipments) as the equivalent of a start, as it actually goes out onto a lot, just like a start does.

Manufactured housing provided some of the lowest cost housing (both for-sale and for-rent) in the housing spectrum and serviced some of the most rural parts of the country with housing.

Take a look at average annual manufactured housing placements (000 units) since the 1950s:

In the 1990s, the financing structure for manufactured housing imploded and the industry has gone south with it to the point that the level of placements currently is less than it was 60 years ago. In the process, nearly a quarter of a million homes per year have disappeared from production.

Apartments don’t replace this stock of new housing easily, since manufactured housing tends to get placed in areas that usually do not have other multi-family options. A zoning tilt away from acceptance of manufactured housing hasn’t helped either.

My guess is that part of the population that was served by relatively inexpensive manufactured housing is now doubling up with relatives or has been added to the homeless population of the country.

Unlike the single family and multi family parts of the housing business, which are growing, the manufactured segment is stuck in neutral and might be shrinking. From 2010 to 2013, placements ranged randomly between 48,000 and 56,000. In 2014 it dropped to 44,000 and projecting out the performance for 2015, it looks like placements will barely crack 40,000.

The second truth is that a significant part of the new housing stock (manufactured housing) that historically has serviced the most affordable housing needs of the population has been decimated and still shows no sign of returning to anywhere close to its prior level of significance.

The fact that we have a growing and palpable affordability problem coupled with a homeless issue is, in part, an outcome of this demise.

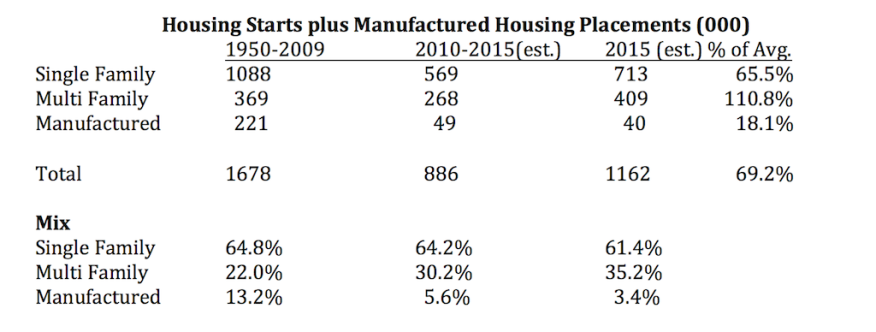

When the entire new housing stock (single family and multi family starts and manufactured housing placements) is surveyed, even though things are getting better, it is nowhere near the historic levels of production that the country has produced since the 1950s.

It looks like 2015 is going to come in with about 1,162,000 total units: 713,000 single-family, 409,000 multi-family (for a total of 1,122,000 combined, which is the composition of the reported start number from the Census), and 40,000 manufactured.

If this is the case, it will be the second straight year that the million new home threshold has been cracked. That’s going in the right direction, but still far off of what has been historically produced, as noted in the beginning.

This deficit is not closing fast enough and the impacts are going to be significant.

Take a look at the 6-decade averages versus the first 6 years of this decade versus the most recent year.

A couple of lessons come from this information.

- Single-family production still is way off of its long-term performance. At nearly two-thirds of production historically, the combination of financing constraints, lot constraints, labor constraints, and delayed household formations are having an impact and the result has been less production than probably needed. The result is an imbalance of supply and demand in many markets where jobs are, higher costs and pricing, and attendant affordability issues in many markets where the jobs are.

- Multi-family production is now running ahead of its historic levels, but behind the go-go decades of the 70s and 80s, when production averaged 602,000 and 499,000, respectively.

- Manufactured housing has cratered and, even though multi-family has improved, it has not taken up the full slack.

- We are still a long way from the long-term average of total housing production. We are currently at 69.2% of the long-term average and closing the gap slowly.

- If this is so, we will most likely continue to have a housing deficit into the foreseeable future, meaning continuing affordability issues in the areas where there are currently jobs and housing demand.

With regard to the housing deficit, here is what it probably looks like by the end of the decade.

Wow!

The third truth is even if this is close to real, it means that we will continue to have a housing shortage and affordability issue that continues to grow, unless the single family part of the business grows at a much higher rate than it has.

Lot availability where people want to live, entitlement delays, and a continuing labor constraint seem to be in control on the supply side, though.

Looks to me like a lot of frustrated folks who will want to buy, will be shut out, even if end-loan financing becomes much more available to a broader and less-credit-worthy population.

But life does not have a “Pause” button, unfortunately; it goes on and people adapt and in those adaptations become opportunities.

I think that the first adaptation is that we will just see more unrelated or non-traditional family combinations using space more efficiently.

In the used home market, it means current homeowners continuing to take in family into rooms and spaces that are not fully used. Adult children will continue to live home with mom and dad. Grandma and/or grandpa might move in, too.

In the new home market, it will mean continuing to work on designs that support multi-generational living. It will probably also mean that house sizing with gravitate more and more toward the smaller end to try to accommodate some of the affordability concerns. When municipalities are willing, detached density will kick in, but this is a tough sell in many places

Existing homes will adapt when feasible to have unrelated occupants, too. Whether it is carving up McMansions into 3 or 4 or 5 “apartments”, taking in boarders, or configuring homes to have Airbnb short-term and long-term tenants, again putting more people into existing space will create more “housing units” in a non-traditional way.

In these opportunities, the ability to do remodeling and reconfiguration will be important and, as I noted in my previous writings, this opens an opportunity for larger and more sophisticated remodeling contractors and another roll-up opportunity for entrepreneurs.

Another possibility will be the adaptive re-use of existing under-used or vacant commercial, retail, and industrial space into housing. Although more entitlement work will be involved, again this takes off on the theme of taking existing space and putting population density into it. The re-use of lofts in urban areas has been accomplished regularly in the past. Its adaptation into suburban areas will most likely be next.

Again, the ability to remodel and renovate will be important.

As long as credit constraints for residential purchasers remain, there will be a continuing need for residential rental product, whether it is single family or multi family; newly built or renovated. It may not be what people want as their first choice, but it will be what they can afford or get themselves into.

Some roof over your head is better than no roof at all (or your parent’s roof).

The ability for entrepreneurs to work in all of these arenas will be important.

This leads to the fourth and final truth. Builder-developers are going to have to learn to succeed in a variety of businesses that are shelter-related if they want to grow and be profitable.

I think that the days of the “one trick pony” are fading away. It was nice being a green-field for-sale residential builder and/or developer for a long while. The truth is that we are going into a period where demand will continue to be in excess of supply, particularly in the areas where good jobs and incomes will be. There will be a lot of political posturing as the affordability and housing crises that is looming plays out.

By looking at a broader definition of the business we are in (providing shelter, rather than just being a single-family for-sale builder), the blinders that limit what we do will be removed for those who will survive.

Opportunity and a growing business are waiting for those willing to attack this non-traditional housing world.

And that’s the rest of the story.

About George Casey

With decades of deep hands-on experience in operations and processes, business consultant and keynote speaker George Casey brings unparalleled insight to a variety of businesses to streamline operations, increase profits and long-term sustainability, especially to the residential development and home building industries.

Join Our Discussion